Mutual Funds

Understanding Net Asset Value (NAV):

Similar to an equity share’s traded price, a mutual fund unit has Net Asset Value per Unit. It represents the market value of all units in a scheme, net of expenses and liabilities, divided by the outstanding number of units. NAV is crucial in tracking a fund’s performance.

Mutual funds suit investors lacking large sums or those who prefer professional management. Fund managers invest according to the scheme’s objective, charging a regulated fee. Despite India’s high savings rate, mutual funds face lower preference due to awareness gaps.

Diversified Investment Options:

Mutual funds cater to diverse financial goals – retirement, education, home purchase, etc. India’s mutual fund industry offers a range of schemes meeting various investor needs. Investors benefit from capital market uptrends, but selecting the right fund requires due diligence, considering risk-return trade-offs and time horizons, or seeking advice from professional advisers. Diversification across equity, debt, and gold categories is vital for maximum benefit.

In summary, while investors can manage securities individually, mutual funds offer a packaged solution with professional management, making them an excellent choice for investors across categories.

Understanding Mutual Fund Option:

Mutual fund schemes come in two types: ‘open-ended’ and ‘closed-ended,’ managed either ‘actively’ or ‘passively.’ Open-ended funds, akin to a savings account, allow continuous subscription and redemption. They are perpetual with no fixed maturity date. Closed-ended funds, like fixed deposits, have a specified tenor and trade on the stock exchange after the initial offer.

Actively managed funds involve a fund manager making decisions for maximum returns and out-performance. Passively managed funds follow a market index without active management. Index funds and Exchange Traded Funds (ETFs) are examples of passive funds, aiming to replicate benchmark returns

Advantages of Investing in Mutual Funds

1. Professional Management: Mutual funds are managed by full-time, professional money managers equipped with expertise, experience, and resources. This professional oversight allows for active buying, selling, and monitoring of investments, ensuring that the fund aligns with its objectives. The continuous portfolio management by skilled fund managers stands out as a significant advantage.

2. Risk Diversification: Mutual funds provide an easy avenue for diversifying investments across various securities and asset categories, including equity, debt, and gold. This diversification spreads risk, preventing a significant impact from market downturns in any one security. Even if a specific investment in the portfolio experiences challenges, others may remain unaffected or even increase in value, highlighting the importance of risk diversification.

3. Affordability & Convenience: Mutual funds allow investors to participate with smaller amounts compared to the potentially higher cost of directly purchasing individual securities. The affordability factor coupled with the convenience of professional management makes mutual funds an accessible investment option for a broader range of investors.

4. Liquidity: Open-ended mutual fund schemes offer liquidity, enabling investors to redeem units on any business day, providing easy access to funds when needed. The redemption process is swift, with the amount typically credited to the investor’s bank account within one to three business days. However, it’s important to note that close-ended mutual funds have maturity-based redemption, and certain funds, like ELSS, have lock-in periods.

5. Low Cost: Mutual funds boast a significant advantage in terms of low costs. Economies of scale allow these funds to maintain a low expense ratio, representing the annual operating expenses as a percentage of the fund’s daily net assets. This cost efficiency is beneficial for investors, as it reduces the overall expenses associated with fund management.

6. Well-Regulated: Mutual funds operate under the strict regulations of the Securities and Exchange Board of India (SEBI), ensuring investor protection, transparency, and fair valuation. SEBI’s regulatory framework establishes stringent rules for mutual fund operations, promoting a secure and well-regulated investment environment.

7. Tax Benefits: Investments in Equity Linked Savings Schemes (ELSS) up to ₹1,50,000 qualify for tax benefits under Section 80C of the Income Tax Act, 1961. Additionally, mutual fund investments held for a more extended period enjoy tax efficiency, making them a favorable option for tax-conscious

SEBI CATEGORIZATION OF MUTUAL FUND SCHEMES

As per SEBI guidelines on Categorization and Rationalization of schemes issued in October 2017, mutual fund schemes are classified as

Equity Oriented Mutual Fund

| Equity Oriented Mutual Fund ( High Risk High Return) | |

| Scheme Category | Objective / Feture of Schemes |

| Large Cap Fund | At least 80% investment in large cap stocks |

| Large & Mid Cap Fund | At least 35% investment in large cap stocks and 35% in mid cap stocks |

| Mid Cap Fund | At least 65% investment in mid cap stocks |

| Multi Cap Fund* | At least 75% investment in equity & equity related instruments ( Min 25% Largecap +25% Midcap +25% Smallcap) |

| Flexi Cap Fund | At least 65% investments in equity & equity related instruments ( Flexibility to Invest across catagoury) |

| Small cap Fund | At least 65% investment in small cap stocks |

| Dividend Yield Fund | Predominantly invest in dividend yielding stocks, with at least 65% in stocks |

| Value Fund | Value investment strategy, with at least 65% in stocks |

| Contra Fund | Scheme follows contrarian investment strategy with at least 65% in stocks |

| Focused Fund | Focused on the number of stocks (maximum 30) with at least 65% in equity & equity related instruments |

| Sectoral/ Thematic Fund | At least 80% investment in stocks of a particular sector/ theme ( For eg: Healthcare, Financial Services, IT ( technology) , FMCG, Infrastructure , Consumption Etc |

| ELSS | At least 80% in stocks in accordance with Equity Linked Saving Scheme, 2005, notified by Ministry of Finance |

Debt Oriented Mutual Fund

| Debt Oriented Mutual Fund ( Low Risk-low Return) | |

| Scheme Category | Objective / Feture of Schemes |

| Overnight Fund | Overnight securities having maturity of 1 day |

| Liquid Fund | Debt and money market securities with maturity of upto 91 days only |

| Ultra Short Duration Fund | Debt & Money Market instruments with Macaulay duration of the portfolio between 3 months – 6 months |

| Low Duration Fund | Investment in Debt & Money Market instruments with Macaulay duration portfolio between 6 months- 12 months |

| Money Market Fund | Investment in Money Market instruments having maturity upto 1 Year |

| Short Duration Fund | Investment in Debt & Money Market instruments with Macaulay duration of the portfolio between 1 year – 3 years |

| Medium Duration Fund | Investment in Debt & Money Market instruments with Macaulay duration of portfolio between 3 years – 4 years |

| Medium to Long Duration Fund | Investment in Debt & Money Market instruments with Macaulay duration of the portfolio between 4 – 7 years |

| Long Duration Fund | Investment in Debt & Money Market Instruments with Macaulay duration of the portfolio greater than 7 years |

| Dynamic Bond | Investment across duration |

| Corporate Bond Fund | Minimum 80% investment in corporate bonds only in AA+ and above rated corporate bonds |

| Credit Risk Fund | Minimum 65% investment in corporate bonds, only in AA and below rated corporate bonds |

| Banking and PSU Fund | Minimum 80% in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds |

| Gilt Fund | Minimum 80% in G-secs, across maturity |

| Gilt Fund with 10 year constant Duration | Minimum 80% in G-secs, such that the Macaulay duration of the portfolio is equal to 10 years |

| Floater Fund | Minimum 65% in floating rate instruments (including fixed rate instruments converted to floating rate exposures using swaps/ derivatives) |

Hybrid Fund ( Mix of Equity and Debt)

| Hybrid Fund ( Mix of Equity and Debt) | Moderate Risk – Moderate Return |

| Scheme Category | Objective / Feture of Schemes |

| Conservative Hybrid Fund | 10% to 25% investment in equity & equity related instruments; and |

| 75% to 90% in Debt instruments | |

| Balanced Hybrid Fund | 40% to 60% investment in equity & equity related instruments; and |

| 40% to 60% in Debt instruments | |

| Aggressive Hybrid Fund | 65% to 80% investment in equity & equity related instruments; and |

| 20% to 35% in Debt instruments | |

| Dynamic Asset Allocation or Balanced Advantage Fund | Investment in equity/ debt that is managed dynamically (0% to 100% in equity & equity related instruments; and |

| 0% to 100% in Debt instruments) | |

| Multi Asset Allocation Fund | Investment in at least 3 asset classes with a minimum allocation of at least 10% in each asset class |

| Arbitrage Fund | Scheme following arbitrage strategy, with minimum 65% investment in equity & equity related instruments |

| Equity Savings | Equity and equity related instruments (min.65%); |

| debt instruments (min.10%) and | |

| derivatives (min. for hedging to be specified in the SID) |

Solution Oriented Schemes

| Solution Oriented Schemes | |

| Scheme Category | Objective / Feture of Schemes |

| Retirement Fund | Lock-in for at least 5 years or till retirement age whichever is earlier |

| Children’s Fund | Lock-in for at least 5 years or till the child attains age of majority whichever is earlier |

Other Scheme

| Other Scheme | |

| Scheme Catagoury | Objective / Feture of Schemes |

| Index Funds/ ETFs | Minimum 95% investment in securities of a particular index |

| Fund of Funds (Overseas/ Domestic) | Minimum 95% investment in the underlying fund(s) |

| Precious Metal | Invests in Gold or Silver Fund / FOF |

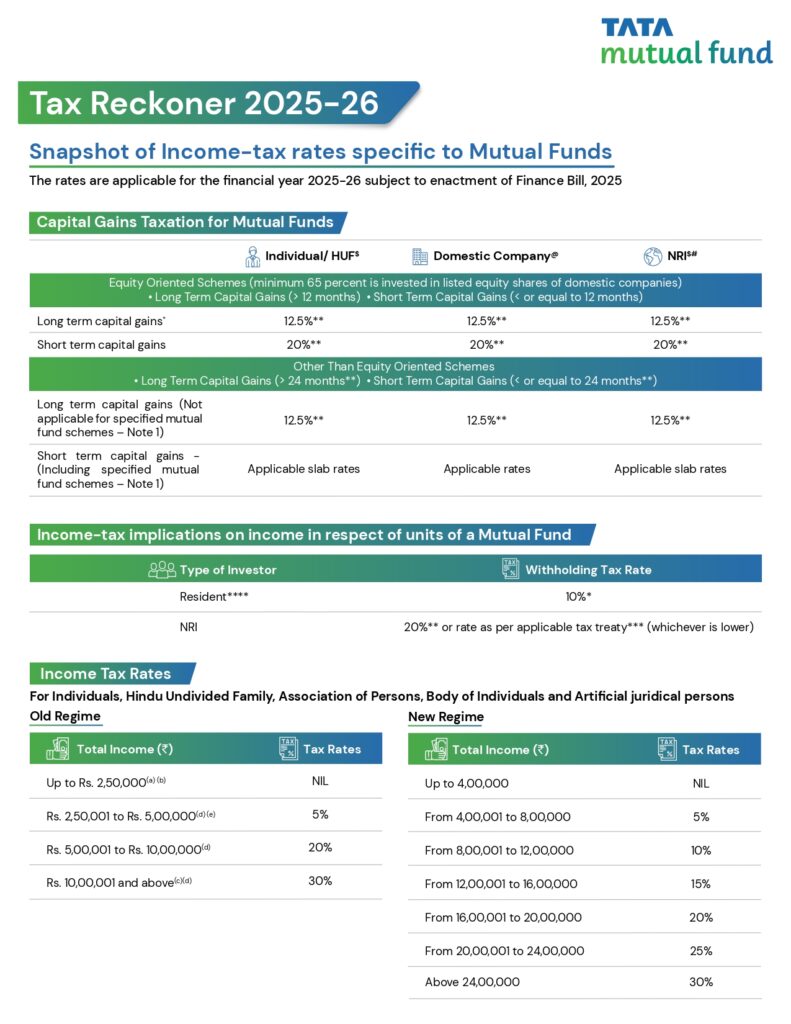

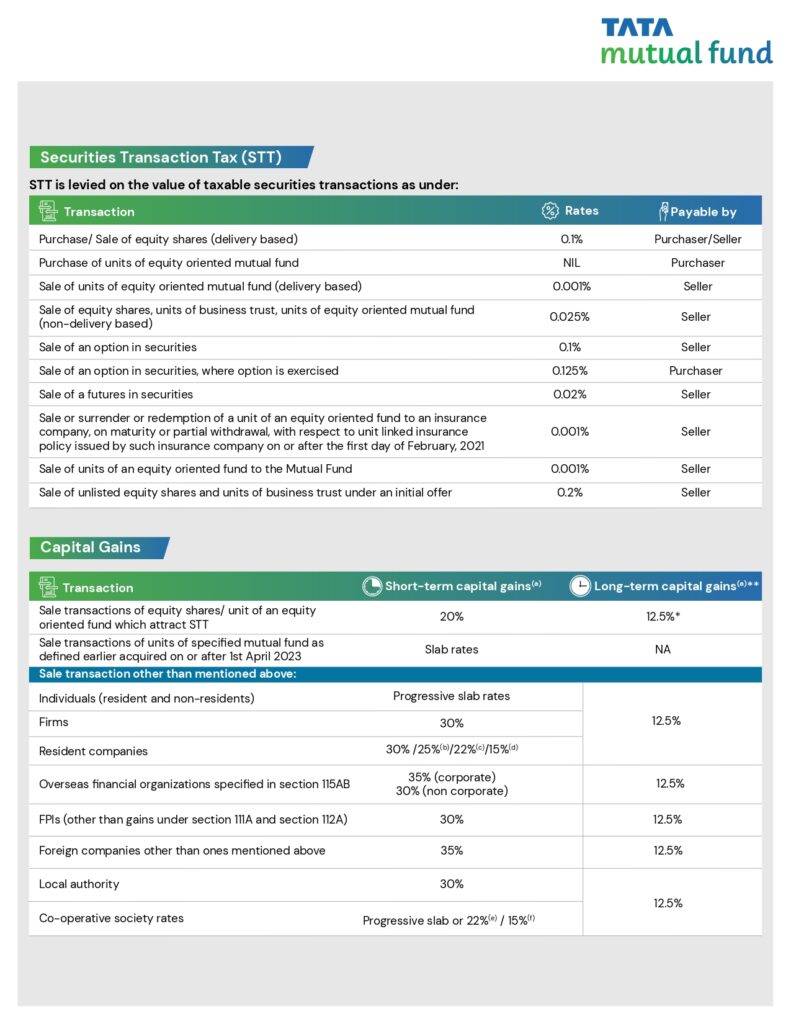

Taxation on Mutual Funds: A Comprehensive Overview

Gain insight into the taxation structure applicable to mutual funds with our comprehensive guide. Whether you’re a seasoned investor or just starting out, understanding the tax implications can significantly impact your investment decisions. Dive into the attached/given tax structure to navigate the complexities and optimize your investment strategy.