AMFI REGISTERED MUTUAL FUND DISTRIBUTOR

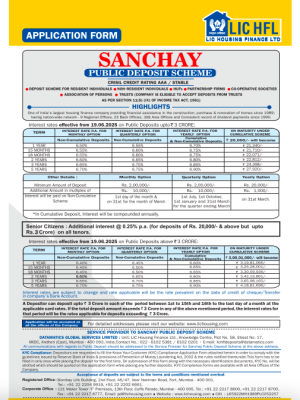

Corporate Fixed Deposit

Corporate Fixed Deposits (FDs) are financial instruments offered by non-banking financial companies (NBFCs) or corporate entities to the public. Unlike traditional bank FDs, corporate FDs provide higher interest rates but come with increased risk. Investors should carefully consider several factors before investing. The issuer’s credit rating is paramount, as it reflects their ability to repay. Higher-rated companies are generally more stable. These FDs offer varied tenures to suit investors’ needs, with interest rates influenced by the tenure and market conditions.

One must be aware of the associated risk, as corporate FDs carry a higher risk of default or delayed payments compared to bank FDs. Premature withdrawals are possible but often incur penalties. Tax implications must also be considered, as interest income is taxable according to the investor’s slab. Corporate FDs are less liquid than bank deposits, requiring investors to commit to the agreed tenure. Thorough research, understanding the issuing company’s financial health, and consulting with a financial advisor are crucial steps before considering corporate fixed deposits.