SIF – Specialized Investment Fund

The investment landscape keeps evolving. To meet the growing demand for flexible and strategy-driven products, SEBI introduced a new mutual fund category, Specialized Investment Funds (SIFs), which came into effect on April 1, 2025.

SIFs are designed to bridge the gap between traditional mutual funds and Portfolio Management Services (PMS). They allow investors to explore advanced investment strategies while staying within SEBI’s regulatory framework.

What are Specialized Investment Funds (SIFs) and How Do They Work?

Specialized Investment Funds are SEBI-regulated Investment strategy that can adopt strategy-specific investment approaches such as long-short equity, sector rotation, and tactical asset allocation.

Unlike traditional mutual funds that generally follow a long-only approach, SIFs can take both long and short positions in securities. They may also use derivatives for hedging or tactical purposes and dynamically adjust allocations across equity, debt, and other asset classes.

Depending on the scheme, SIFs can be structured as open-ended or interval funds, each with its own liquidity terms. Asset Management Companies (AMCs) managing SIFs are governed by SEBI’s mutual fund regulations along with additional provisions applicable to this category.

In simple terms, SIFs offer investors a regulated way to participate in professionally managed, strategy-driven investing.

Who Can Invest in SIFs?

Investors need a minimum investment of ₹10 lakh (aggregated across all investment strategies of SIF under a single AMC at the PAN level) to participate. This ensures that investors have the financial capacity to engage with relatively sophisticated strategies that may have lower liquidity.

Accredited investors, as defined by SEBI, may be exempt from this minimum threshold. AMCs offering SIF strategies may also provide Systematic Investment Plans (SIPs), Systematic Withdrawal Plans (SWPs), and Systematic Transfer Plans (STPs), provided that the investor’s overall commitment meets the minimum investment threshold.

Investment Strategies in SIFs

SIFs can follow different investment strategies based on their structure and objectives. Broadly, these fall under three categories: Equity-Oriented, Debt-Oriented, and Hybrid Strategies.

Equity-Oriented Strategies

These funds primarily invest in equities and equity-related instruments. They can take long and short positions (up to 25% via unhedged derivatives). Within this category, several strategies are recognized:

- Equity Long-Short Funds: Holding a minimum of 80% in equity and equity related instruments, these funds aim to capture both upward and downward market movements using long and limited short equity positions.

- Equity Ex Top 100 Long-Short Funds: With minimum investment of 65% in equity and equity related instruments in stocks outside the top 100 by market cap, targeting pricing inefficiencies in mid and small-cap segments.

- Sector Rotation Long-Short Funds: Investing in equity and equity related instruments of maximum four sectors with a minimum of 80% allocation, these funds can tactically adjust sector weightings, including limited short positions at the sector level.

Debt-Oriented Strategies

Debt-oriented SIFs invest in fixed-income instruments with potential short exposures in debt derivatives. Strategies include:

- Debt Long-Short Funds: Investing across various duration debt instruments with up to 25% unhedged short exposure, through exchange traded debt derivative instruments.

- Sectoral Debt Long-Short Funds: Allocating to at least two sectors in debt markets with maximum investment of 75% in a single sector, these funds aim to control concentrations including unhedged short exposure limits of up to 25%.

Hybrid Strategies

These combine different asset classes, allowing dynamic asset allocation and shorting within the prescribed risk limits, with a maximum short exposure through unhedged derivative positions in equity and debt instruments of 25%:

- Active Asset Allocator Long-Short Funds: Offering broad flexibility to rebalance dynamically across several asset classes such as Equity, debt, equity and debt derivatives, REITs/InVITs and commodity derivatives based on market conditions,

- Hybrid Long-Short Funds: Maintaining at least 25% each in equity and debt instruments with tactical short positioning and rebalancing, typically structured as interval funds.

Liquidity and Redemption

Liquidity in SIFs varies depending on the fund’s structure and strategy. Some may offer daily redemption like regular mutual funds, while others may allow withdrawals at fixed intervals such as weekly, monthly, or quarterly.

Redemption periods may also require advance notice of up to 15 working days. Investors should review the liquidity terms carefully to ensure they align with their investment horizon and capital requirements.

Benefits and Risks of Investing in SIFs

Like any market-linked investment, SIFs present both potential opportunities and risks. Understanding them helps investors make confident, informed decisions.

Potential Benefits

- Access to advanced investment strategies not typically available in traditional mutual funds.

- Ability to undertake both long and short positions, which may provide diversification and hedging opportunities.

- Broad diversification possibilities across equity, debt, alternatives, and derivatives.

Risks to Consider

- Higher minimum investment thresholds restrict access to investors prepared for more substantial capital commitments.

- Some strategies may have lower liquidity, longer lock-in periods, and exit restrictions compared to traditional mutual funds.

- Use of leverage, derivatives, and short positions introduces strategy-specific risks, including potential for amplified losses and increased volatility.

- Dependence on fund manager expertise and execution capabilities.

How SIFs Differ from Traditional Mutual Funds?

Feature | Specialized Investment Funds (SIFs) | Traditional Mutual Funds |

Investor Eligibility | Minimum Investment threshold of ₹10 lakh at PAN level across investment strategies offered by the SIF Provided that the requirement of minimum investment amount shall not apply to an accredited investor. | Open to investors, with low minimum investment (₹100-₹500) |

Investment Approach | Long-short equity, tactical asset allocation, limited unhedged short derivatives exposure. | Primarily long-only equity, debt or hybrid. |

Liquidity | Variable liquidity: daily to periodic redemptions with notice periods as notified in Investment Strategy Investment Document. | Typically, daily liquidity |

Risk Profile | Generally higher due to leverage and complex strategies | Generally moderate to very high depending on fund type |

Suitability and Investor Considerations

SIFs may be suited for investors who:

- Can commit ₹10 lakh or more and have sufficient understanding of complex investment strategies.

- Are comfortable with higher volatility, strategy complexity, and variable liquidity.

- Aim to seek portfolio diversification into less conventional asset classes and strategies.

- Are prepared for longer investment horizons aligned with redemption terms.

Before investing, investors should review their financial goals, risk appetite, and liquidity needs, and consider consulting a SEBI-registered financial advisor.

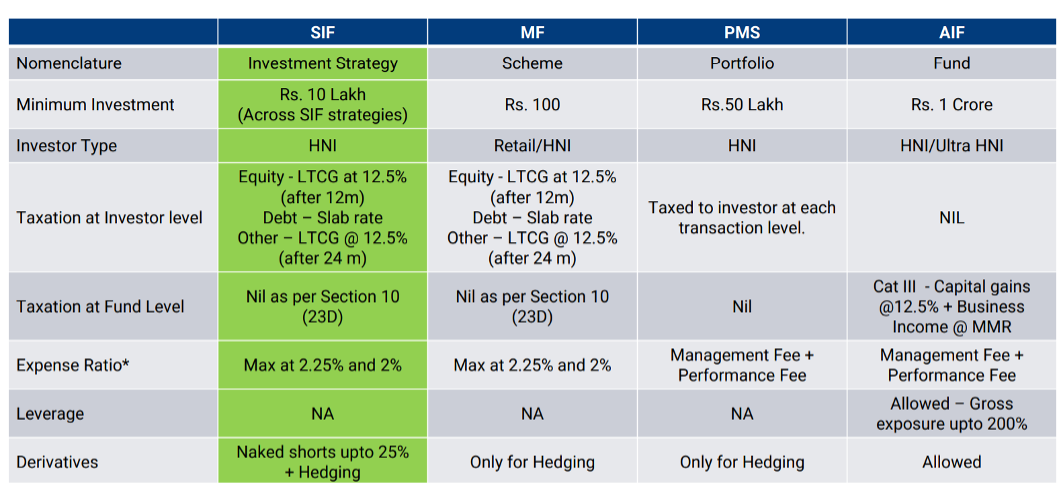

SIF VS MF VS PMS/ AIF

Disclaimer

Investments in Specialized Investment Fund involves relatively higher risk including potential loss of capital, liquidity risk and market volatility. Please read all investment strategy related documents carefully before making the investment decision.