All About SIP

SIP, or Systematic Investment Plan, is a popular investment strategy that allows investors to regularly invest a fixed amount in mutual funds. It offers several benefits, making it a convenient and effective way to achieve financial goals.

SIP instills a disciplined approach to investing by automating regular investments. Investors can contribute small amounts periodically, helping them stay committed to their investment journey. SIPs enable investors to purchase more units when prices are low and fewer units when prices are high. This averaging effect helps reduce the impact of market volatility over time, potentially enhancing returns.

SIPs offer flexibility in terms of investment amounts and frequency. Investors can choose the amount they want to invest and the interval at which they want to invest, aligning with their financial capabilities and goals.

Through regular investments and the power of compounding, SIPs have the potential to generate significant wealth over the long term. Even small, consistent investments can grow into substantial sums over time.

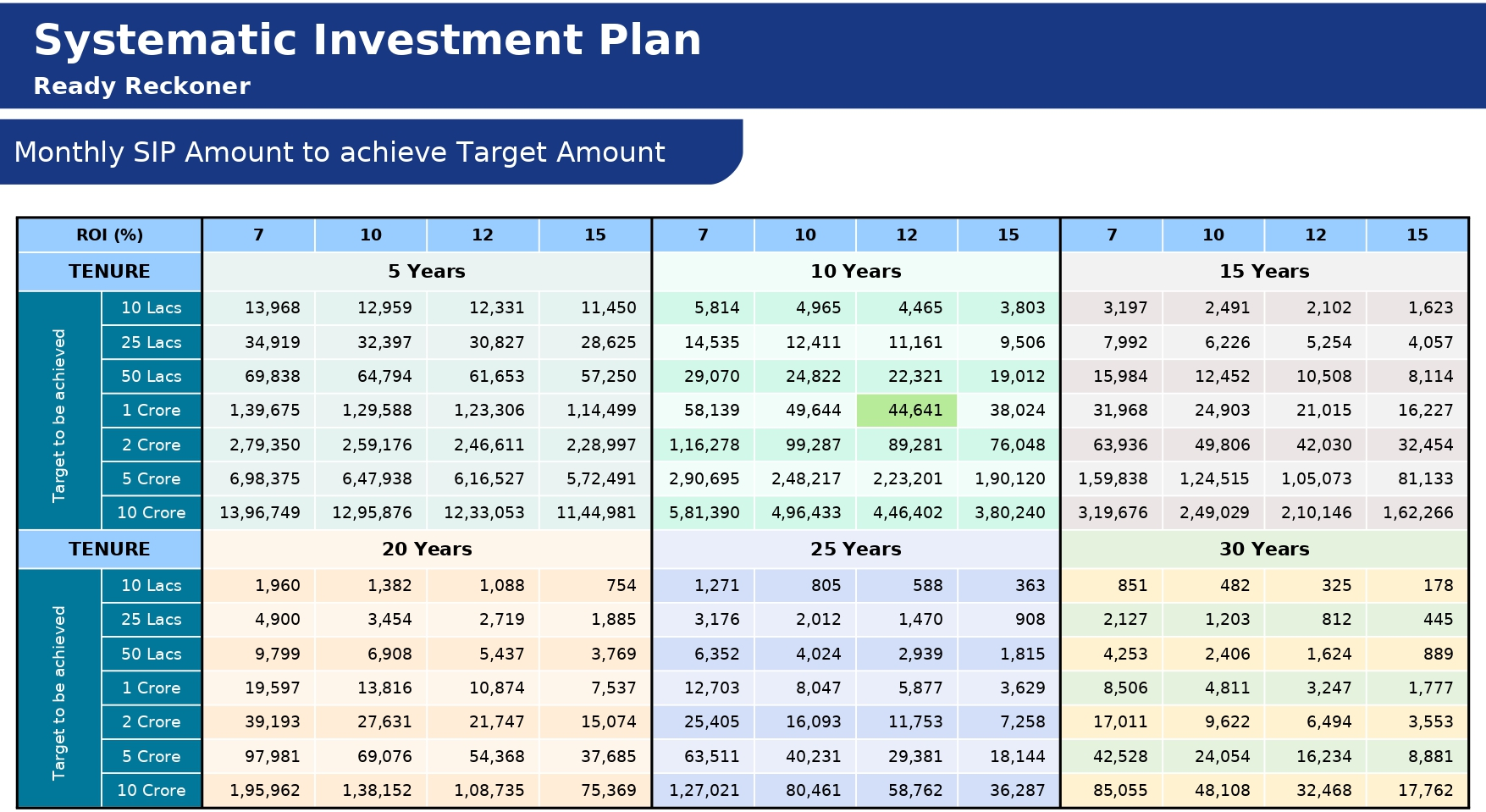

Ready reckoner For SIP Investment

Point to Rember ( For SIP )

1. Start with Small Amounts:

Begin your investment journey with SIPs starting as low as Rs 100 or Rs 500, depending on the mutual fund company. It’s a flexible and affordable way to start investing.

2. Choose Your Investment Type:

Pick from different categories like:

- Liquid or Debt Funds

- Growth-oriented Equity Funds (with or without tax benefits)

- Precious Metal Gold /Silver Funds

- Index Funds tracking market indices

- Hybrid Funds or Multi Asset Fund

- Global Funds exploring international markets

Choose based on your financial goals, risk comfort, and how long you plan to invest.

3. Pause or Stop Anytime:

Life is unpredictable. Pause or stop your SIP anytime with just a 30-day notice. It gives you the flexibility to adapt your investments according to your changing needs.

4. Adjust Your Investment Amount:

Change your SIP amount whenever you want, either increasing or decreasing it. It’s designed to fit your evolving financial capacity.

5. Add Extra Funds Anytime:

Besides your regular SIP, add extra money whenever you have more to invest. It’s a bonus on top of your regular savings.

6. Access Your Money when Needed:

You can withdraw or redeem your accumulated money whenever required. Just check for any exit charges or taxes before making a move.

7. ELSS Redemption After 3 Years:

If you’re investing in ELSS, remember you can only redeem units that have completed 3 years. It’s not about the SIP duration but the individual units.

8. Exit Load for Other Schemes:

For non-ELSS investments, be aware of exit loads. If you redeem your units too soon, you might incur load charges.( Apart from Capital Gain if any)

9. SIP for All Goals:

Whether it’s short-term needs or long-term dreams, SIPs help you reach your financial goals. Select the right schemes and asset classes based on what you want to achieve.

10. Understand Market Risks:

Mutual funds investment are subject to market risks. Before you start, read the Scheme Information Document (SID) carefully.

SIP is not a Product or Investment instrument, it’s a disciplined mode of investing in mutual funds. By investing systematically and consistently, you harness the power of compounding, making your journey towards financial goals more achievable. SIP allows you to navigate the market with discipline, making the investment process accessible, flexible, and tailored to your individual needs. Start your SIP journey today for a financially secure tomorrow.

SIP Study

Q1. Which Date to Select for Monthly SIP?

Start of the Month? End of the Month? Middle of the Month? Near the Last Thursday of the month because of higher volatility due to F&O expiry? Splitting SIP amount into multiple date SIPs?

We tried answering these commonly asked questions using long-period data from S&P BSE Sensex TRI (a widely tracked Indian Equity Market Index). The study of the last 26 years’ index data reveals no meaningful difference between the average return of different dates’ 10 Years SIPs.

The best SIP date in our view, is when an investor usually receives money in his/her bank account (For Eg. Salary Credit Day).

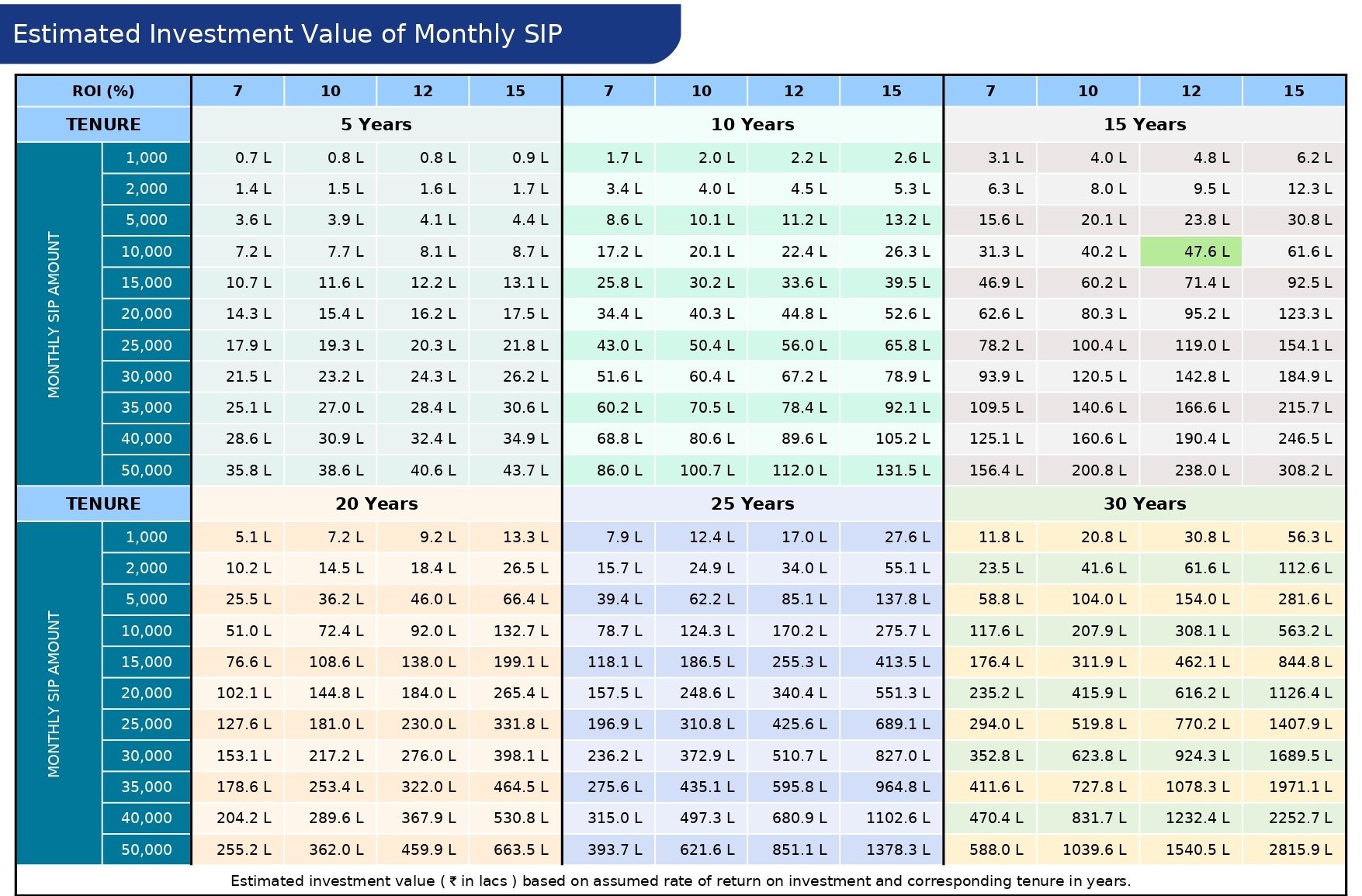

Q2. Which SIP Frequency to Select?

A historical data analysis provided below suggests that, in the long term, it hardly matters if the investor invests via Daily, Weekly, or Monthly SIP Frequency. All three frequencies end up generating somewhat similar returns (% XIRR).

The key takeaway from the analysis is to focus on investing a small amount regularly for the long term. (Data for S&P BSE Sensex TRI)

Starting a SIP early and running it for the long term is more important than what frequency one selects!

Q3. Isn’t it better if I time my monthly purchases?

- Only in hindsight would we know, what would have been the best day to invest during a month. It is impossible to consistently time the market levels.

- Waiting for the right time to invest can lead to missed opportunities

- Not investing at all is a more significant loss than entering an unfavorable market

- Even the worst market timing will help grow wealth

It’s time in the market, not timing the market.

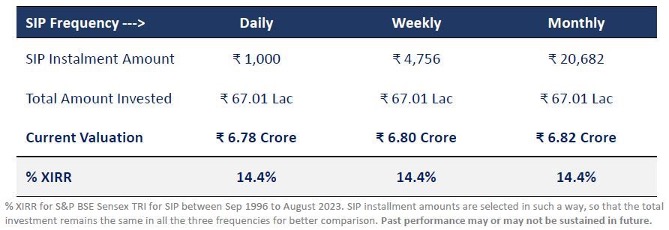

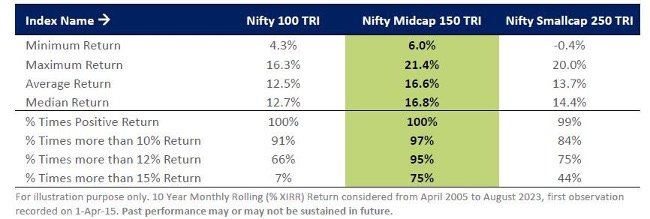

Q4. Large Cap, Mid Cap or Small Cap SIP?

As we all know, an average Large Cap stock is generally less volatile than an average Small and Mid Cap stock and provides stability to the portfolio. However, the Small and Mid Cap (SMID) segments may offer many opportunities for potential higher growth in the long run.

One should Start investing through Sip route , keeping in mind his risk taking capacity, Investing Time horizon and his /her financial Goal. One can Start SIP in liquid fund , Debt fund , Gold Fund or hybrid fund apart from equity oriented mutual Funds.

Q5. What is an Ideal Investment Time Horizon for SIP?

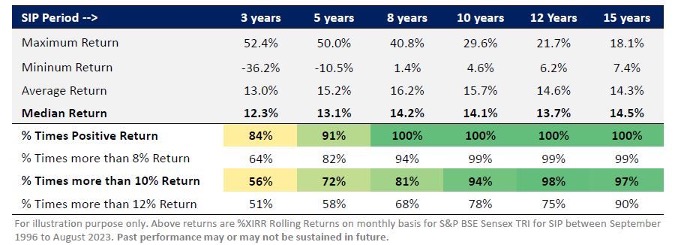

Experts often suggest investors invest for the “Long-term,” but what exactly is “Long-term”? What is the “Ideal Investment Horizon”? Or is there anything called an “Ideal Investment Horizon”? Equities have proved to be a volatile asset class in the past. But, the study reveals volatility reduces as investors increase their investment horizon. (Data for S&P BSE Sensex TRI)

Longer the Investment Horizon, Higher is the Probability of receiving decent Returns!burt one should not forget his investment objective and time attached to his Financial Goal.

(This SIP study, conducted by White Oak Capital Mutual Fund, attempts to address some of these commonly asked questions around SIP investment backed by long-period market indices data.)

Please Note, This SIP study, conducted by White Oak Capital Mutual Fund, attempts to address some of these commonly asked questions around SIP investment backed by long-period market indices data. Mutual Fund Investments are subject to market risk, Please read SID carefully before investing.

CONTACT US

Have Questions?

Contact With Us Anytime

-

CONTACT US ON

CONTACT US ON

+91 7710011477 +91 7710011478 -

SEND EMAIL

SEND EMAIL

su*****@**********ts.com -

ADDRESS

ADDRESS

201, Shree Vishnu Niwas, Ghantali Devi Road,(Opp Ghantali Devi Mandir), Naupada, Thane ( West) -400602